Introduction

BYJU’S, the prominent Indian ed-tech company founded by Byju Raveendran in 2011. With celebrity endorsements from Bollywood superstar Shah Rukh Khan and soccer legend Lionel Messi, BYJU’S initially dominated the market. However, its fortunes took a sharp downturn, leading to financial struggles and even bankruptcy despite once sponsoring the FIFA World Cup in 2022.

Explore the company’s journey from origin to its rise and eventual fall, drawing valuable lessons from this case study.

Origin

BYJU’S, named after its founder Byju Raveendran hailing from Kerala. Raised by a mother who taught math and a father who taught physics, Raveendran’s upbringing fostered a passion for learning despite initially skipping school to pursue education at home.

Following his Btech, Raveendran ventured into a career as a service engineer with a multinational shipping company. However, his innate knack for teaching became evident when he started assisting friends preparing for the CAT exam, where he excelled, consistently scoring in the 100th percentile.

In 2007, Raveendran officially established BYJU’S Classes, specializing in test preparation, which rapidly expanded to accommodate stadium-sized classes. In 2011, he furthered his educational vision by co-founding BYJU’S alongside his wife, Divya Gokulnath, whom he had met during her time as a student in his exam preparation classes.

BYJU’S – The Rise

BYJU’S experienced a remarkable ascent, transitioning swiftly from traditional classroom teaching in Bengaluru to introducing its groundbreaking product, the BYJU’S learning app, in 2015. This app proved to be a game-changer, receiving an astounding response. Consequently, it soared to become the most highly valued ed-tech platform and learning app worldwide.

BYJU’S metamorphosis from a humble startup to a dominant force in the EdTech industry is a testament to the power of visionary leadership, innovation, and an unwavering commitment to democratizing access to quality education for all.

Tech-Driven Teaching

Amid the rapid proliferation of smartphones and advancing technology, Raveendran adeptly pivoted towards the development of a learning app. BYJU’S seamlessly integrated itself into the digital landscape, making its presence felt on every smartphone.

Distinguished by its innovative, interactive, and captivating content, BYJU’S introduced a novel approach to education.

Modernizing technology

BYJU’S revolutionized conventional education by integrating interactive videos, animations, and adaptive learning methods into its curriculum. The app tailored personalized lessons, enhancing both enjoyment and effectiveness in education.

In 2016, the company reported that its app had garnered over 5.5 million downloads within the past year, with 2,50,000 of those users becoming paid annual subscribers.

Marketing

BYJU’S embarked on an expansion journey, acquiring numerous emerging ed-tech startups and forging partnerships with schools through extensive marketing efforts.

Soon, BYJU’S extended its reach to 150 million users spanning across 120 countries.

Diversified Growth

BYJU’S not just confined to its subscription-based business model, diversifying its revenue streams significantly.

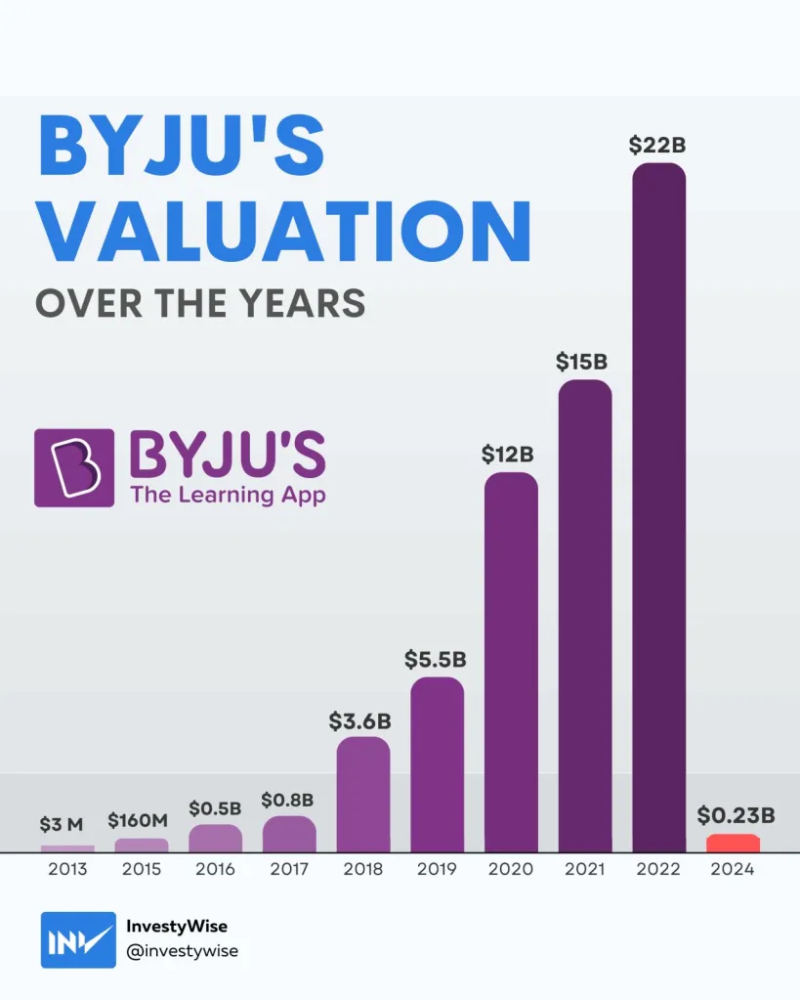

In 2022, BYJU’S generated a revenue of 3,569 crores from three main sources: sales of tablets & SD cards, reference books, and tuition & service fees. During this time, BYJU’S claimed the title of India’s most valued startup, boasting a valuation of 22 billion dollars.

But; Proving the old saying, “What goes up must come down,” BYJU’S success story did not last long.

BYJU’S – The Fall

Despite witnessing significant revenue growth of thousands of crores, BYJU’S faced a parallel surge in losses, escalating from 49 crores in 2016 to 249 crores in 2020. This trend intensified drastically, with losses skyrocketing by 18 times to reach 4,588 crores in 2021, and doubling further to 8,200 crores in 2022, as per the most recent filings.

Simultaneously, the company’s valuation plummeted from $22 billion in 2022 to below $3 billion today.

Deviation from core-principles

BYJU’S was well-known for its creatively unique teaching techniques and continuous innovation. However, it later started deviating from its core principles. Initially focused on transforming online education, BYJU’S later shifted towards selling hardware items such as SD cards and tablets.

The company faced criticism for its aggressive marketing tactics in promoting these products, which failed to resonate with customers.

Over acquiring

BYJU’S swiftly acquired multiple ed-tech companies with the aim of monopolizing the market, but this strategy did not yield the desired results. Acquisitions like Aakash and Great Learning were made without adequate planning.

BYJU’S overextended itself, acquiring more than it could effectively manage. These acquisitions proved to be unprofitable and had drawbacks.

Debt trap

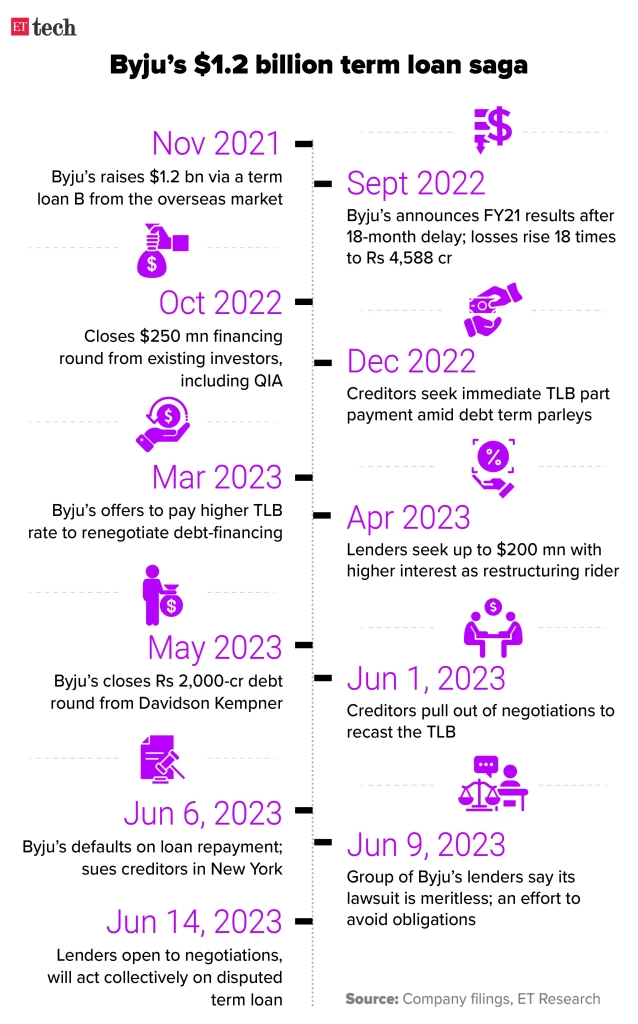

BYJU’S encountered a substantial financial hurdle with its $1.2 billion debt trap, as outlined below:

- In November 2021, BYJU’S secured a $1.2 billion term B loan[1] from the international market for its business expansion. However, financial difficulties arose due to delayed audited results and a significant loss reported in FY21.

- On June 5, BYJU’S failed to make its quarterly interest payment of $40 million, triggering a legal dispute with creditors and resulting in a lawsuit against Redwood, one of its lenders.

- Despite never defaulting on repayment, BYJU’S lenders demanded immediate repayment of the entire loan.

- The debt dispute escalated as creditors sued BYJU’S for violating loan covenants, exposing a $271 million loss in FY22 amidst challenges in navigating a post-Covid economic downturn.

- BYJU’S came under regulatory scrutiny, with its offices raided and accusations of fund concealment, leading to a decline in its valuation and struggles to fulfill its debt obligations.

Lessons from The BYJU’S case study

Over-marketing: Marketing can be a double-edged sword, as evidenced by Byju’s experience. Over-promotion to parents led to criticism of the company.

Staying true to values: Businesses should maintain their core values while pursuing growth. Focusing solely on scale can result in a deviation from these principles.

Trust: Byju’s faced trust issues due to lack of transparency about its losses, declining valuation, and failure to repay interest. Building trust takes time, but it can be lost in an instant.

Over-acquiring: It’s essential not to take on more than a company can handle. Rapid expansion strategies may yield short-term gains but can lead to long-term difficulties.

Debt trap: Effective financial management is crucial. Even a billionaire can face significant challenges without proper financial management.

Terminologies

Term B Loan: This is a type of loan provided by financial institutions to businesses, usually for medium to long-term financing needs. It typically has a fixed repayment schedule over a specified term and may have higher interest rates than other loans due to the associated risks.

For more articles, visit Finshots Daily.